Facts About Personal Loans Canada Uncovered

, but that's technically not a personal car loan (Personal Loans Canada). Individual loans are made through a real monetary institutionlike a bank, debt union or online lending institution.

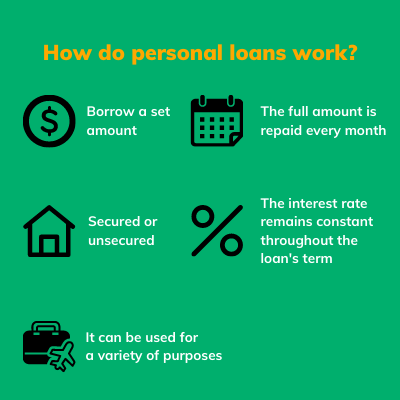

Allow's have a look at each so you can understand precisely just how they workand why you don't require one. Ever. Many individual finances are unprotected, which suggests there's no security (something to back the loan, like an auto or home). Unprotected financings usually have higher passion prices and call for a better credit history due to the fact that there's no physical thing the lending institution can take away if you do not pay up.

Personal Loans Canada Fundamentals Explained

No matter just how excellent your credit scores is, you'll still have to pay interest on the majority of personal loans. Protected personal fundings, on the other hand, have some sort of security to "protect" the loan, like a watercraft, jewelry or RVjust to name a few.

You could likewise get a secured individual lending using your car as collateral. That's a dangerous action! You do not want your major setting of transportation to and from job obtaining repo'ed due to the fact that you're still spending for in 2015's kitchen area remodel. Trust us, there's nothing safe and secure about guaranteed finances.

However simply because the repayments are foreseeable, it does not suggest this is an excellent bargain. Like we said before, you're practically assured to pay interest on a personal funding. Simply do the math: You'll wind up paying method extra in the lengthy run by getting a funding than if you would certainly simply paid with money

Our Personal Loans Canada PDFs

And you're the fish hanging on a line. An installation loan is an individual loan you repay in fixed installments gradually (usually as soon as a month) till it's paid completely - Personal Loans Canada. And do not miss this: You need to pay back the original finance amount prior to you can obtain anything else

Do not be misinterpreted: This isn't the same as a credit scores card. With personal lines of important link credit score, you're paying rate of interest on the loaneven if you pay on time.

This one obtains us riled up. Due to the fact that these companies prey on people who can not pay their costs. Technically, these are temporary loans that offer you your paycheck in advancement.

Personal Loans Canada Fundamentals Explained

Because points get real messy actual quickly when you miss a payment. Those creditors will certainly come after your sweet grandmother who guaranteed the loan for you. Oh, and you must never ever guarantee a lending for any person else either!

All you're truly doing is making use of brand-new debt to pay off old debt (and extending your financing term). Companies understand that toowhich is exactly why so many of them provide you debt consolidation car loans.

And it starts with not borrowing anymore cash. ever before. This is an excellent general rule for any kind of economic purchase. Whether you're thinking about securing an individual car loan to cover that kitchen remodel or your frustrating credit history card expenses. don't. Obtaining debt to pay for points isn't the means to go.

The Ultimate Guide To Personal Loans Canada

The very best point you can do for your economic future is get out of that buy-now-pay-later frame of mind and claim no to those spending impulses. And if you're thinking you could check here about an individual lending to cover an emergency, we obtain it. Yet borrowing money to pay for an emergency situation only intensifies the stress and hardship of the circumstance.